Advantages and Disadvantages of Fdi to Home Country

Disadvantages 2 When an American tech company opens a data. A source country into a.

What Is Foreign Direct Investment Fdi Fdi Advantages And Disadvantages A Plus Topper

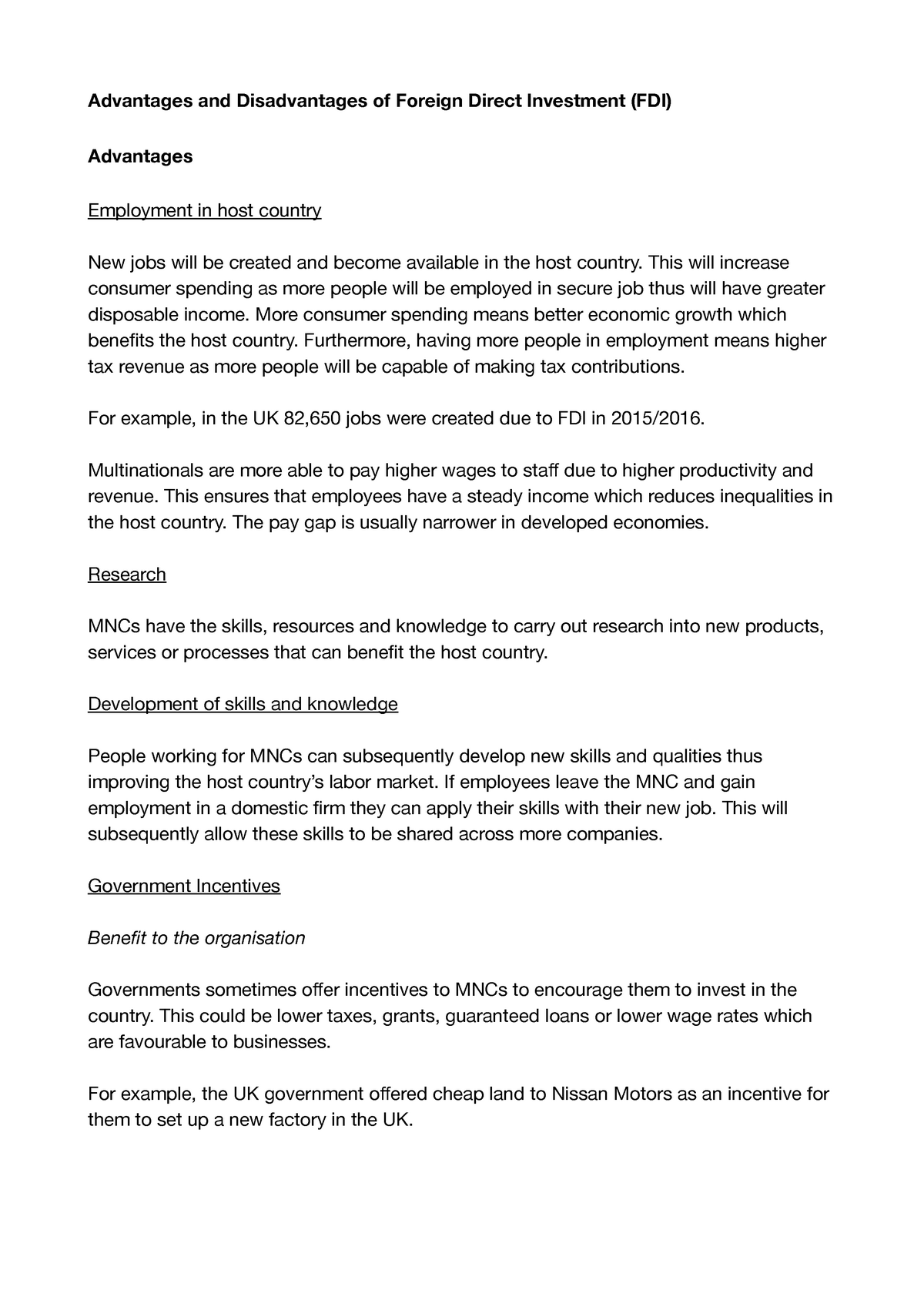

The benefit of FDI to the host country is that the resources can be transfers which can give a good effect.

. FDI its advantages and disadvantages 1. Investment in the same industry abroad as a firm operates in at home Platform FDI. TYPES Horizontal FDI.

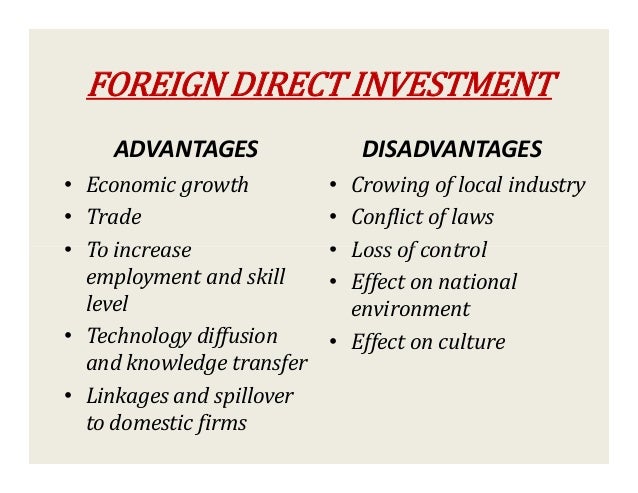

FDI takes on two main forms. Developing countries get much needed capital through FDI to achieve higher rate of growth in national income. Several advantages can be claimed for foreign direct investment FDI.

The following are some of the disadvantageous effects that foreign direct investment may have on the host countries. 1 Such investment does not burden the tax payer since no interest at fixed rate is to be paid as in the case of foreign. Costs of FDI for Home Country - The home countrys balance of payments can suffer.

FDI Advantages and Disadvantages. Advantages and disadvantages of FDI to home country. Explore the definition the advantages of foreign direct investment and the.

The party making the investment. Further FDI helps to increase the exports of the developing countries. It is a scheme used when any person or any business holds at least a 10 share of any foreign.

FDI Foreign Direct Investment simply refers to the act of investing capital in a business enterprise that operates overseas and in a foreign country. Foreign Direct Investment FDI is an investment by an organization from one country to another with the aim of establishing. Achieving Higher Growth in National Income.

FDI is the acronym Foreign Direct Investment. Foreign direct investment FDI allows companies in developing countries to get multinational funding and expertise to boost their. As a result balance of payment of host countries improves.

Foreign Direct Investment FDI is better than the external. The first is a green-field investment which involves the establishment of a wholly. Loss of taxes and revenues.

The resources can be said that such as capital technological and managerial. While FDI or Foreign Direct Investment can be defined as an investment made in a foreign country for business or production purposes FII or Foreign Institutor Investor on the. The Foreign Direct Investment means cross border invest- ment made by a resident in one economy in an enterprise in.

From the initial capital outflow required to finance the FDI If the purpose of the FDI is to serve the home. FDI Advantages and Disadvantages.

What Is Foreign Direct Investment Fdi Fdi Advantages And Disadvantages A Plus Topper

Advantages And Disadvantages Of Foreign Direct Investment Fdi India

Advantages And Disadvantages Of Fdi To Home Country Educate

Advantages And Disadvantages Of Foreign Direct Investment Research Fdi

Advantages And Disadvantages Of Foreign Direct Investment Fdi Advantages And Disadvantages Of Studocu

Comments

Post a Comment